Government Shutdowns and Your Portfolio: History Says Don’t Panic

What a Government Shutdown Means for Your Investments

You’ve likely seen headlines about the government shutdown and the political discussions surrounding it. While these events often capture significant media attention and may raise concerns, it’s important for investors—especially those planning for or living in retirement—to keep the broader perspective in mind.

First things first: government shutdowns aren’t unusual.

Since 1976, the U.S. government has shut down more than 20 times. While government shutdowns can be frustrating and disruptive, they’re not new, and they’re usually short-lived.

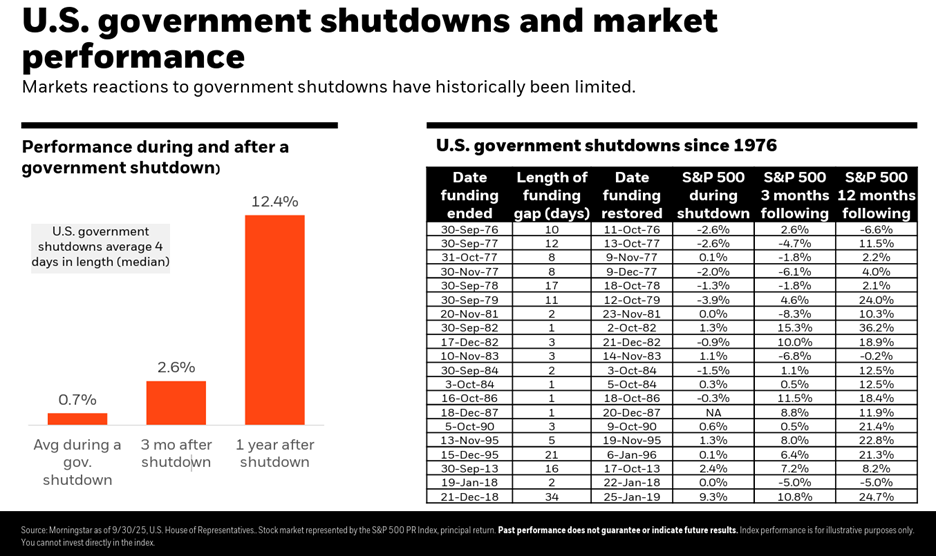

Just two years ago, Congress narrowly avoided a shutdown by passing a temporary funding bill. Back in 1977, the government shut down, reopened, and shut down again—all within three months. So, while it might feel like today’s gridlock is worse than ever, history shows we’ve been here before. Not one has caused a recession or a major market downturn. In fact, in many cases, the stock market has gone up during and after a shutdown. For example, the longest shutdown ever—35 days in late 2018 and early 2019—happened during a time when the stock market was actually rising.

How long do shutdowns usually last?

On average, about a week or 7.8 days to be exact. During these periods, the stock market has mostly shrugged them off. U.S. stocks have returned an average of 0.6% during shutdowns, and the market has been positive about 70% of the time from the start of a shutdown to its end.

Looking further ahead, the picture gets even better.

In the year following a shutdown, the stock market has delivered an average return of nearly 12.4%, with positive performance 90% of the time. Even after the second-longest shutdown in 1995–1996, the market rose 6.4% in the next month and 21.3% over the following year.

So what’s the takeaway? History shows government shutdowns don’t usually hurt the stock market or the economy in a lasting way.

However, this doesn’t mean shutdowns have zero impact. They can slow down government spending, delay programs, and temporarily affect the economy. For example, during the 34-day shutdown in 2018–2019, the U.S. economy grew a bit slower—by about 0.4% in the first quarter, according to the Congressional Budget Office.

Also, important economic data—like monthly reports on jobs and inflation—can be postponed. This can make it harder for the Federal Reserve to make decisions about interest rates in the short term.

But overall, the impact on the economy is usually small. Most government spending continues during a shutdown. Programs like Social Security, Medicare, and payments on U.S. debt keep going. And when the government reopens, furloughed workers typically get back pay, which helps restore lost income and spending.

The good news? These effects usually reverse once the government reopens.

Paychecks resume, spending picks up, and the economy gets back on track.

Markets understand this. Shutdowns haven’t changed long-term trends in corporate earnings, inflation, or consumer behavior. In fact, markets often rise during shutdowns because investors know how the story ends.

As an investor, it’s important to focus on the bigger picture. Political headlines can be noisy, but they’re rarely the main driver of the markets. What really moves stock prices are things like company earnings, interest rates, and consumer spending.

Shutdowns may grab headlines, but they’re usually short-term events with limited impact on your portfolio. History shows that markets tend to recover quickly—and often thrive—once the dust settles.

Tony Powers, AIF®, CFP®, CRPS® Shareholder

Tony Powers, President of KerberRose Wealth Management, has more than 20 years of experience in the financial services industry. He specializes in helping private and public sector employers set-up and manage their employee retirement plans. Tony provides Fiduciary Services and Support, Plan Design Consultation, Plan Benchmarking and Financial Wellness.